child tax credit 2021 dates canada

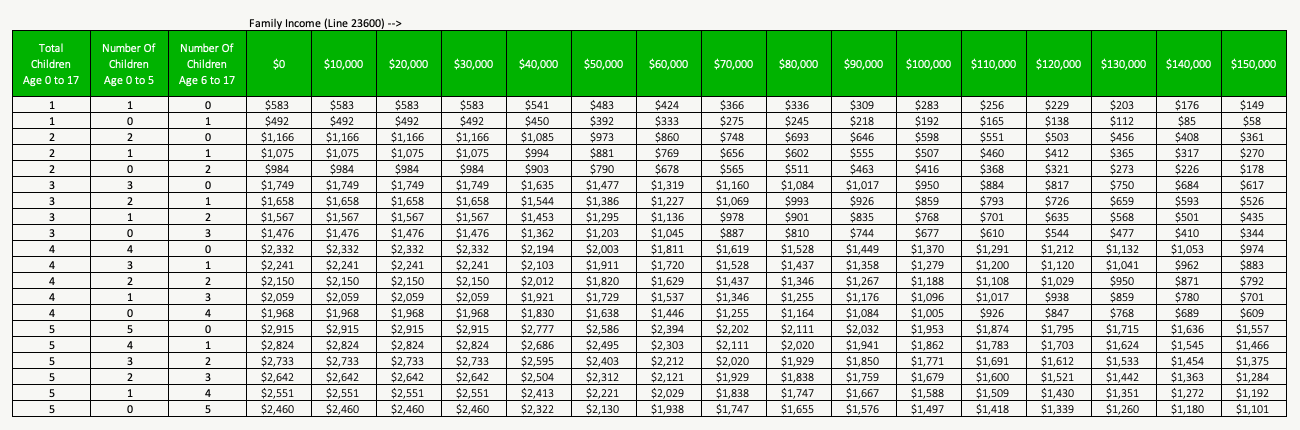

Canada child benefit payment dates. The Canada child benefit young child supplement CCBYCS provides support to families with young children in 2021.

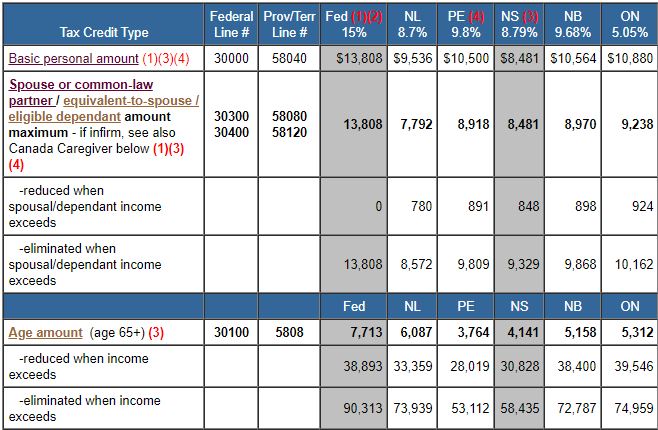

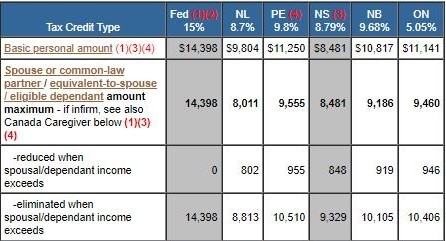

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

The CCB young child supplement CCBYCS is part of Canadas.

. From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17. The Canada Revenue Agency CRA granted a one-time top-up of 300 in May 2020 to eligible Canada Child Benefit CCB recipients. Lets condense all that information.

The american rescue plan act made several changes to the child and dependent care credit for the 2021 tax year. The CRA makes Canada child benefit CCB payments on the following dates. 13 opt out by Aug.

On March 11 2021 President Biden signed into law the American Rescue Plan Act expanding the Child Tax Credit and providing historic tax relief to the vast majority of families. 15 opt out by nov. The CRA has increased the regular CCB amount after adjusting the payment for inflation and income.

11000 for expenses between October 1 2020 and December 31 2021. This means you can reduce your 2021 federal tax bill by 1157 15 of 7713. Your five-year-old child can get you as much as 8000 in CCB.

For 2022 the payment dates are. One of the best things about having children in Canada compared to other countries is getting a bit of a financial supplement from the government for doing so. In this article I cover the Canada Child Benefit payment dates for 2021 and 2022 CCB amounts eligibility requirements increases and how to apply.

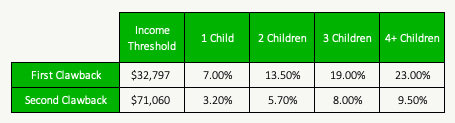

Posted by Puja Tayal Published February 23 2021 400 pm EST. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The CCB will pay more than the additional 1200 CCB.

ACFB payments are issued by the CRA in four installments. However the age tax credit amount depends on your income. 150000 or less for married couples filing a.

November 25 2022 Havent received your payment. The 500 nonrefundable Credit for Other Dependents amount has not changed. The maximum amount you can claim for your home renovation expenses is.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. 3 January - England and Northern Ireland. Wait 10 working days from the payment date to contact us.

The CRA created CCB to support mid- to low. Apply for child and family benefits including the Canada child benefit and find benefit payment dates. October 5 2022 Havent received your payment.

The CDB is included in CCB payments for those who qualify and payment dates occur on the same dates as the CCB as follows. By August 2 for the August. Its usually around the 20th of the month but some dates are different for example December its a.

Canadas 2021 tax deadline is still April 30. In a case where your ACFB payment is under 10 for the quarter it may be combined and paid less frequently. 15 opt out by Aug.

This is a non-refundable tax credit meaning it lowers the total taxes you owe when you file your return. 3000 for children ages 6 through 17 at the end of 2021. To be eligible for the maximum credit taxpayers had to have an AGI of.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The maximum credit you can claim is. Child Tax Benefit Dates 2022.

All payment dates. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The payments are scheduled to go out on the 15th of each month for the rest of the year.

If your 2021 net income is below 38893 the CRA will. Here are the child tax benefit dates for 2021 so you know when you are going to get paid. Families that have a child who is eligible for the disability tax credit may qualify for a Child Disability Benefit CDB and this payment is included in the CCB amount they receive.

Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment. Your payment dates tax credit payments are made every week or every 4 weeks. Canada child tax benefit Universal child care benefit GSTHST credit Canada workers benefit Provincial and territorial benefits Childrens special allowances.

A cheque is either mailed to you or the funds are deposited in your bank account. 3600 for children ages 5 and under at the end of 2021. 75000 or less for singles 112500 or less for heads of household and.

While families do not need to apply separately for this supplement they must already be receiving the CCB for a child under the age of six and complete their 2019 and 2020 tax returns to get the CCBYCS payments. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Despite renewed school and business shut-downs in parts of the country due to the third wave of the COVID-19 pandemic Ottawa did not prolong the.

The maximum Canada Disability Benefit for the period of July 2021 to June 2022 is 24291 per month or 2915 per year. The remaining 2021 child tax credit payments will be. Similarly the increased payments in the 2021-22 benefit period.

9000 for expenses between January 1 and December 31 2022. Alberta child and family benefit ACFB All payment dates. Child Tax Credit 2022.

In the November 2020 Fall Economic Statement the Government of Canada proposed an additional supplement be offered to families entitled to the Canada child benefit CCB with children under the age of six for the year 2021 to provide relief during Canadas recovery from COVID-19. The CRA has made huge changes to the Canada Child Benefit in 2021. Canada child benefit payment dates.

For every 8 you pay into this account the government will pay in 2 to use to pay your provider. When It Is Deposited. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the.

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

What Are Marriage Penalties And Bonuses Tax Policy Center

Canada Child Benefit Payment Dates 2022 Filing Taxes

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Canada Child Benefit Ccb Payment Dates Application 2022

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Canada Child Benefit Vs The Universal Child Care Benefit 2022 Turbotax Canada Tips

Canada Child Benefit Ccb Payment Dates Application 2022

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Canada Child Benefit Ccb Payment Dates Application 2022

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Going Native Was Produced With Participation And Assistance From Canada Media Fund Cmf Cptc Manitoba Film Music Mfm Participation Manitoba Tax Credits

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Canada Child Benefit Vs The Universal Child Care Benefit 2022 Turbotax Canada Tips

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

A Notice Of Assessment Or Noa Is A Statement From The Canada Revenue Agency Notifying The Taxpayer Of The Amount Of Tax They Assessment Tax Credits Income Tax